What Does the Shift from AI Infrastructure to Applications Mean for Investors?

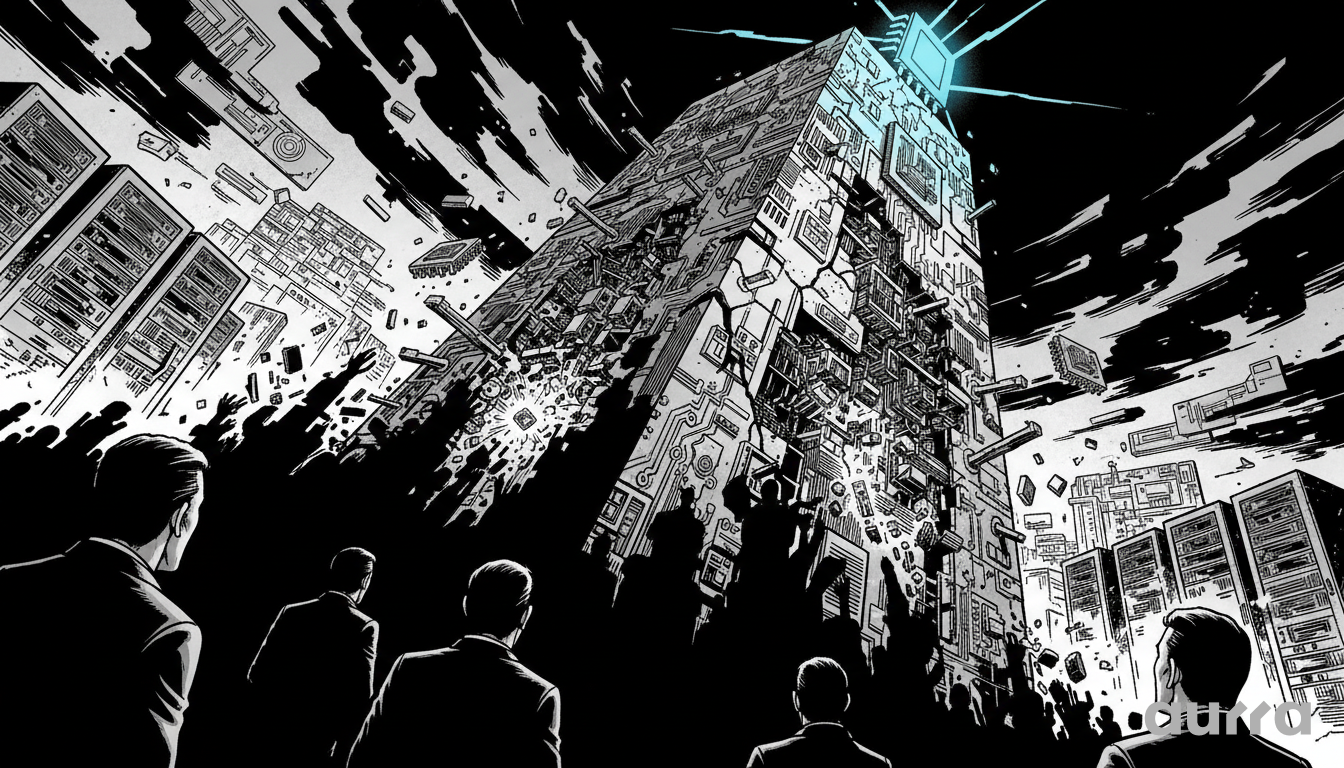

China's artificial intelligence (AI) market is undergoing a significant transition, moving away from infrastructure investments towards application-focused developments. This shift presents exciting opportunities for investors looking to capitalize on the burgeoning AI sector.

What Is Driving the Change in China’s AI Market?

The rapid evolution in China's AI landscape is fueled by substantial interest from local investors, particularly in stocks related to generative engine optimization (GEO). This new focus stems from a belief that brands will increasingly invest in getting their products featured in AI-generated results, thereby reshaping advertising strategies within the country.

Wei Wang, a researcher at Tianjin University of Commerce, notes that recent trends indicate growing investor confidence following Meta Platforms' acquisition of Manus, a company known for advancing generative AI tools. Wang emphasizes, "AI agents and its monetization opportunity … is likely to be the top investment theme in 2026."

Technology is great, but sometimes you need a human. Whether you have a question about a deposit or a technical issue, you shouldn't have to talk to a robot.

🤝 We are Here to Help: Our team is ready to assist you during market hours. Discover our commitment to client success and support at Why Choose Us.

Which Companies Are Positioned to Benefit?

Investors are particularly keen on major players within China's internet ecosystem: Tencent, Alibaba, and ByteDance. Analysts from Bank of America suggest that Alibaba stands out as a prime proxy for the "AI in China" theme due to its strong presence in both e-commerce and AI cloud services.

- Alibaba upgraded its Qwen AI application to facilitate user interactions, allowing individuals to shop and order food directly through the app. With more than 100 million monthly active users, this integration highlights Alibaba's strategic endeavors in the AI field.

- Tencent, which operates the widely popular WeChat application, is also leveraging AI by implementing chatbots that enhance user interaction and advertisement effectiveness. Recent reports from Goldman Sachs identify Tencent as a key beneficiary in the AI application landscape, especially considering its diverse range of services in games, advertising, and finance.

- ByteDance leads with its Doubao application, which has gained massive traction in China. ByteDance is currently experimenting with incorporating AI functionalities directly into smartphones, ensuring it remains at the forefront of the AI race.

How Are Investment Strategies Shifting in Response?

Amidst this evolving landscape, investment strategies are pivoting significantly. With the indicator of a rising GEO market projected to be worth 3 billion yuan ($430 million) in 2026, investors are increasingly favoring stocks that integrate these advanced AI applications. Analysts predict traditional advertising practices will transition to more ROI-driven methods incorporated with GEO strategies.

New and professional traders have different needs. You shouldn't be forced into a complex commission structure if you are just starting out.

⚖️ Find Your Fit: From the zero-commission Standard Account to the institutional-grade ECN Account, we have a setup for every level. Choose your ideal structure on our Trading Accounts dashboard.

What Future Trends Should Investors Watch?

As AI technology continues to develop, it is expected that companies embracing these innovations will lead the market. The shift from infrastructure to application poses risks and uncertainties, but it also offers unique opportunities for savvy investors willing to adapt to these emerging trends. Global monetary trends are being mirrored in mainland China's trading patterns, where local investment capital is pouring into Hong Kong-listed stocks such as Alibaba and Tencent, influencing price trajectories significantly.

Key Takeaways

- Transition Focus: China's AI market is moving from infrastructure to application, driven by investing in generative engine optimization.

- Key Players: Major companies benefitting include Alibaba, Tencent, and ByteDance.

- Strategic Changes: Investment strategies are evolving towards AI applications, with a predicted surge in the GEO market.

- Future Outlook: 2026 emerges as a critical year for AI applications, possibly reshaping consumer habits and advertising strategies.

To see how this data impacts your investments, read our latest market analysis.

References

[^1]: Evelyn Cheng (2026-01-25). "China's AI trade moves from infrastructure to applications. Watch these stocks (https://www.cnbc.com/2026/01/25/chinas-ai-trade-moves-from-infrastructure-to-applications-stocks-to-watch.html)". CNBC. Retrieved 2026-01-25.

Keywords:

China AI market, AI applications, Alibaba, Tencent, ByteDance, investment opportunities, generative AI, marketplace trends.

Aurra Global Markets Limited License Number: GB25204837 (Financial Services Commission of Mauritius)

Infrastructure: MetaTrader 5 (MT5) | Institutional-Grade Liquidity | Native Crypto-Funding

The Standard: We are not just a broker; we are the infrastructure for the next generation of global traders.

🛡️ Security Verification:

You are trading with Aurra Markets International. We are a distinct, independent financial institution. We are not associated with 'Aura FX', 'Auro Markets', 'Aurora', or 'Aura Funded'. Always verify your URL: Ensure you are connected to the official www.aurra.markets.